Our key workers have done a tremendous job of containing the health crisis as best as they can and deserve every last clap across the country. But what of the aftermath and the economic crisis that is upon us ? How will mortgage lenders recover from the Covid crisis ? What recovery strategies worked in the Financial Crisis a decade ago ?

As firms begin to emerge from this lockdown phase, mortgage leaders are focusing on the next set of hurdles as they prepare for the recovery. The bridge from first response to the recovery is a critical one.Join our CEO speak to a panel of mortgage leaders from industry and academia across the UK and the US. Register for this free webinar on " After the clapping stops : Recovery Strategies for Mortgage Lenders ".

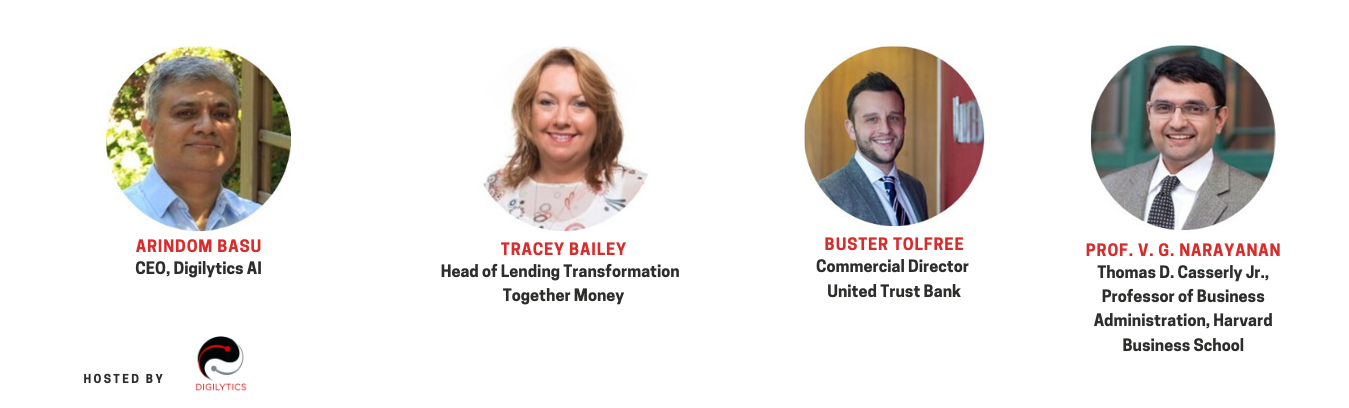

CEO and Founder at Digilytics AI. Experienced technology disruptor with a demonstrated history of working in the financial services and consumer industry sectors. Entrepreneur with a degree in computer sciences and management, Arindom has spent almost 30 years witnessing technology evolution through crisis times.

Tracey Bailey, Head of Lending Transformation, Together Financial Services LimitedTracey is the head of lending transformation at together financial services limited. She has 20+ years of Operational Leadership experience both in day to day operations and in Senior Leadership position shaping and delivering change and growth throughout the entire organisation. She manages service and productivity within the organization via a strategic change programme within an ever-changing and evolving regulatory framework.

Buster Tolfree, Commercial Director, United Trust BankExtensive experience in the management of large operational teams of up to 100+ staff across a variety of functions. Previous roles cover the entire product lifecycle including sales and marketing, underwriting, customer and arrears management, litigation and asset management specifically within the mortgage and consumer lending markets.

V.G. Narayanan, Chair of the MBA Elective Curriculum & the Thomas D. Casserly, Jr. Professor of Business Administration, Harvard Business SchoolV.G. Narayanan is the Chair of the MBA Elective Curriculum and the Thomas D. Casserly, Jr. Professor of Business Administration at the Harvard Business School. Professor Narayanan has been teaching at the Harvard Business School since 1994. He has taught courses in Financial Reporting, Measuring and Driving Corporate Performance, and Building and Sustaining a Successful Enterprise. He serves on the boards of several companies. He studies performance management, retail banks, and boards of directors. He is the author of the book: An Easy Introduction to Financial Accounting: A Self-Study Guide.