The Covid crisis has had a major impact on the balance sheets of governments. How will governments recover from this ? And what will be the impact on lending over the next 2-5 years is a topic of keen debate.

The webinar aims to bring together leaders from industry and academia to examine the likely macro-economic trends to influence lending in global economies over the next few years. Register for this free webinar on "Through the Looking Glass : Post COVID Macroeconomic Trends in Lending".

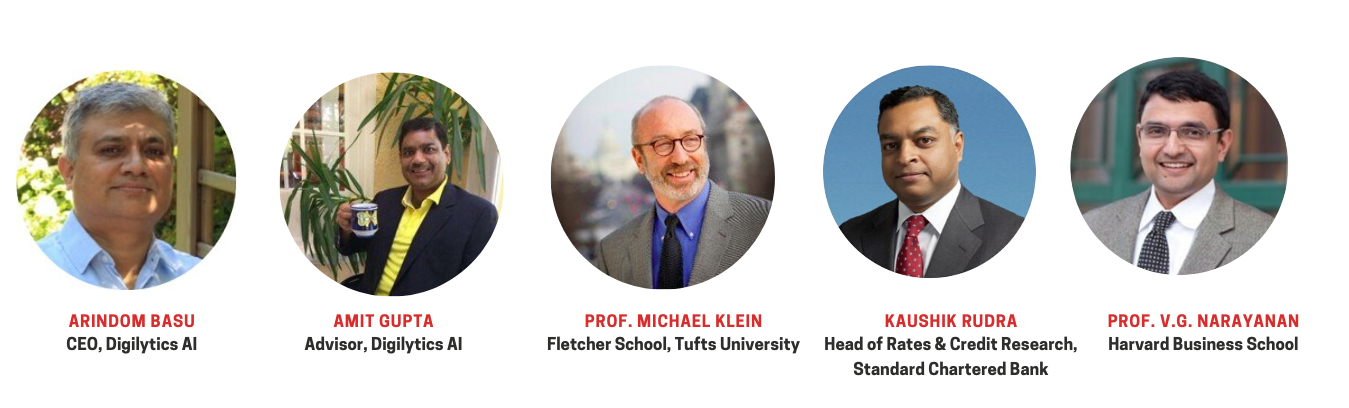

CEO and Founder at Digilytics AI. Experienced technology disruptor with a demonstrated history of working in the financial services and consumer industry sectors. Entrepreneur with a degree in computer sciences and management, Arindom has spent almost 30 years witnessing technology evolution through crisis times.

Amit Gupta, Advisor at Digilytics AIMr Amit Gupta served as Chief Executive Officer of Singapore Branch at HSBC Private Bank (Suisse) SA. Mr. Gupta joined HSBC in 1992 and has been Treasurer, Managing Director and Head of Global Markets for HSBC Singapore since 2008.

Michael Klein, Professor at Tufts UniversityMichael W. Klein is the William L. Clayton Professor of International Economics Affairs at the Fletcher School, Tufts University and a Research Associate of the National Bureau of Economic Research. He is the Founder and Executive Editor of EconoFact (www.econofact.org) a nonpartisan digital publication launched in January 2017 to present analysis of timely economic policy issues. He served as Chief Economist in the Office of International Affairs at the United States Treasury from June 2010 to December 2011.

Kaushik Rudra, Head of Rates & Credit Research at Standard Chartered Bank, SingaporeKaushik leads the Rates and Credit Research teams globally, based in Singapore. His teams leverage the Bank’s strong on-the-ground presence in all of its key markets to produce highly differentiated transaction-oriented research. The Credit and Rates Research teams have strong followings and have ranked consistently highly in their respective categories. Kaushik has over 25 years of experience in emerging markets, having covered Latin America, EMEA and Asia from New York, London and Singapore. Before joining Standard Chartered in 2008, Kaushik worked at Lehman Brothers and Morgan Stanley, where he was responsible for global EM strategy. Previously, he was an economist with the World Bank in Washington. He holds an MBA in finance from the Stern School of Business (New York University), and Master's degrees in international finance from Georgetown University and economics from the Delhi School of Economics.

V. G. Narayanan, Professor at Harvard Business SchoolChair of the MBA Elective Curriculum and the Thomas D. Casserly, Jr. Professor of Business Administration at the Harvard Business School. Professor Narayanan has been teaching at the Harvard Business School since 1994. He has taught courses in Financial Reporting, Measuring and Driving Corporate Performance, and Building and Sustaining a Successful Enterprise. He serves on the boards of several companies. He studies performance management, retail banks, and boards of directors. He is the author of the book An Easy Introduction to Financial Accounting: A Self-Study Guide.