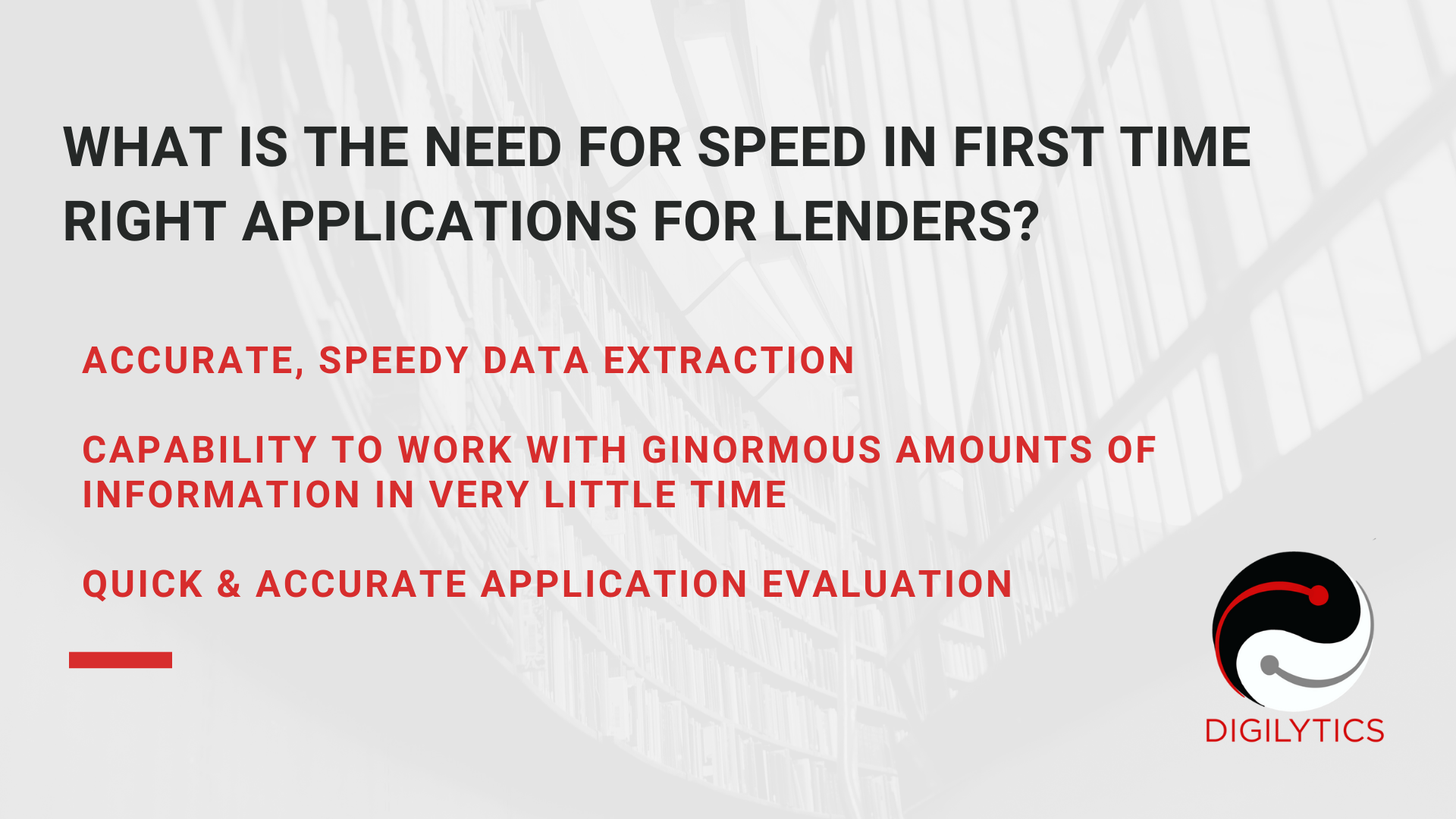

Digiliytics RevEL for AI financial services is first of its kind, easy to use AI product for revenue growth, built on the most advanced AI technology, making the lending experience seamless. It reduces time to offer for mortgage lenders. The product can be launched from an existing loan origination system, with bulk document upload and document classification into configured file structure. This reduces non-value manual tasks, augments decision making by providing granular visibility.

Digiliytics RevEL has the capability to extract data from the document and map it onto relevant fields of Loan Origination System, perform data validation and annotation check on the documents. RevEl for financial services improves the broker/customer experience, accuracy, increases colleague’s productivity, reduces cancellations, and increases repeats.

With Document comparison view, case risk score with label of standard/accelerated case and document pending alerts, RevEL for AI financial services helps you predict service level agreement breaches specifically catering to the Mortgage Lending UK Industry.

Read More

Read More

Previous

Previous

Next

Next